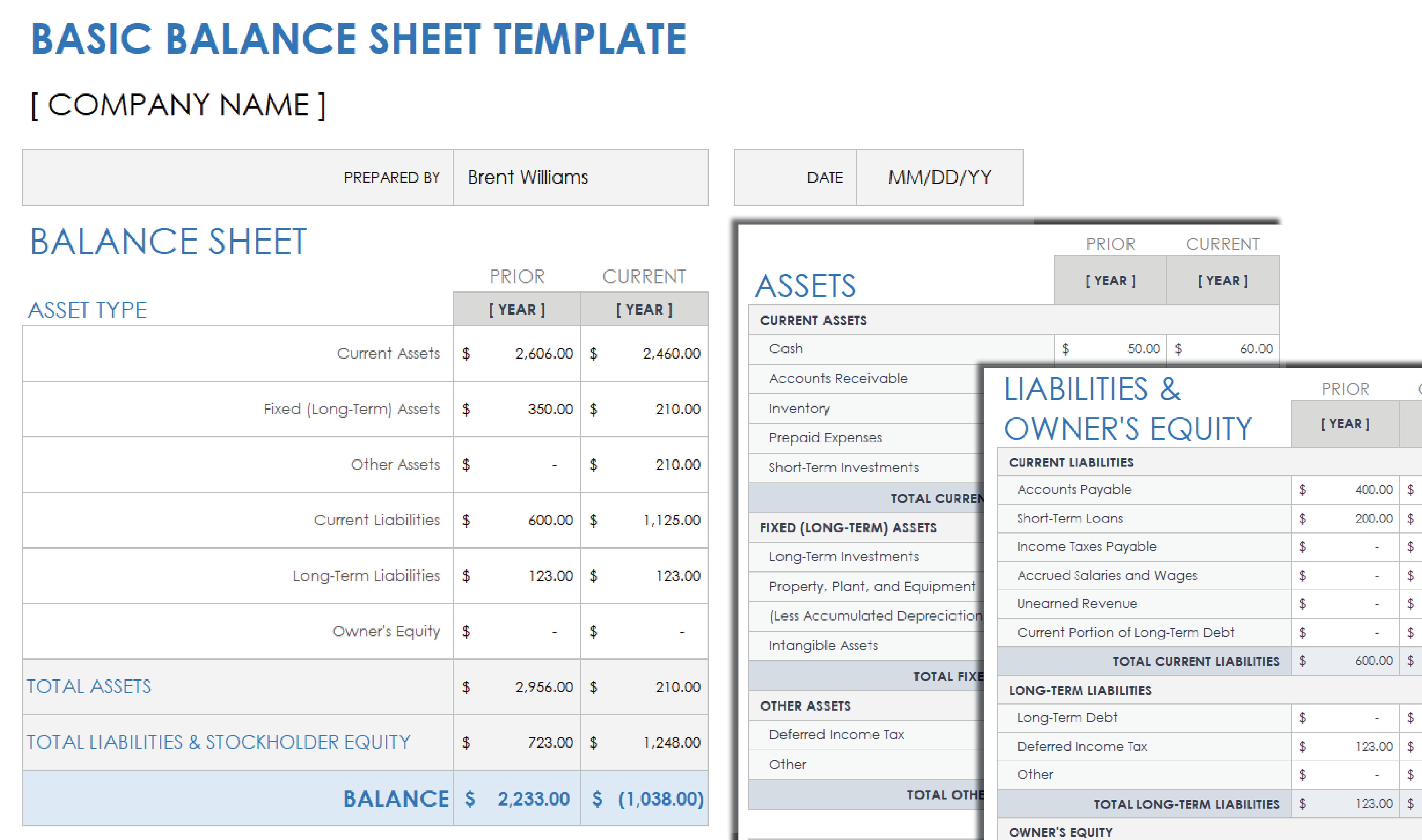

After the primary yr, your car could be shown on the stability sheet at the buy value of $40,000 minus $8,000 accumulated depreciation, for a internet e-book worth of $32,000. Some examples of tangible property https://www.simple-accounting.org/ are real estate, furniture, etc., and intangible ones are goodwill, copyright, and so on. These footnotes might simply offer clarification, but at instances they could even be a discreet place for the enterprise to share data it does not wish to draw attention to. It can be offered at a later date to boost money, and even reserved to repel a hostile takeover. There are a couple of frequent parts that traders are prone to come across.

- In the U.S., property are listed on a stability sheet with probably the most liquid items (i.e., these which may be easiest to sell) listed first and longer-term belongings listed decrease.

- A sturdy stability sheet enhances a company’s credibility and attractiveness.

- A steadiness sheet offers an summary of an organization’s financial position by taking stock of what it owns, what it owes and the worth of its fairness.

- By comparing your earnings statement to your balance sheet, you’ll have the ability to measure how effectively your small business makes use of its complete assets.

- Buyers may even calculate this ratio earlier than investing in your business.

To create a personal balance sheet, begin by amassing related financial information out of your financial institution, investment corporations and collectors. Using a personal finance app, similar to You Want A Finances (YNAB), can be helpful throughout this sort of deep dive. YNAB syncs together with your bank and investment accounts, permitting you to assign funds to totally different life categories to better assist you to visualize your finances. A widespread misconception is confusing stability sheets with different monetary documents. Understanding what a steadiness sheet is can clarify these variations.

The debt-to-total property ratio reveals how a lot of a business is owned by creditors versus how much of the company’s property are owned by shareholders. The debt-to-equity ratio is calculated by dividing a company’s whole liabilities by the whole equity of its shareholders. As proven in the formulation calculation below, in your stability sheet, your complete property ought to at all times equal your complete liabilities plus shareholder’s equity. Debts and other obligations to collectors that might be due throughout the subsequent 12 months. Examples of present liabilities embody accounts payable, bank card payments, sales taxes collected, payroll liabilities and loan payments. Money, as properly as different property you count on to turn into cash inside the subsequent 12 months.

At CNBC Choose, our mission is to provide our readers with high-quality service journalism and complete shopper recommendation to allow them to make informed decisions with their cash. Every article is predicated on rigorous reporting by our team of professional writers and editors with intensive knowledge of monetary merchandise. Companies use steadiness sheets to point their monetary standing.

How Is The Steadiness Sheet Used In Financial Modeling?

Then, as you document transactions (such as mortgage payments or depreciation), the software program updates your balance sheet in the background automatically. To show you ways assets, liabilities, and equity work together, let’s observe how taking out a mortgage, shopping for tools, making a mortgage payment, and claiming depreciation have an result on a balance sheet. The commonest method in stability sheet accounting is to subtract liabilities from property to get equity. Similarly, placing a particular value on intangible belongings like brand value or mental property may be subjective and hard to find out. So, the stability sheet may not provide the full picture of what these assets are value.

Current Liabilities (short-term Liabilities)

This gives stakeholders an opportunity to see how the company’s monetary position has changed. Although the balance sheet is an invaluable piece of knowledge for buyers and analysts, there are some drawbacks. Many financial ratios draw on data included in each the steadiness sheet, revenue statement, and assertion of cash flows to paint a fuller image of what is going on on with a company’s business.

When you combine these two amounts, the whole should match your belongings. This balance shows that your financial information are correct and everything is accounted for. If the totals don’t match, double-check your figures to make sure nothing was left out or miscalculated. Steadiness sheets report a company’s belongings, liabilities, and small business fairness at a sure time.

That same logic typically applies to the liabilities and shareholders’ fairness sections, the place probably the most liquid components usually seem first. This simple method tells you that every thing an organization owns is both paid by borrowing cash (liabilities) or by taking it from buyers. The money circulate assertion takes your internet revenue and provides again the amortization because it is not a money expense. These modifications in turn affect the ending money balance, which will be shown on the balance sheet. The truck shall be shown on the balance sheet at a reduced value due to amortization.

Following firm financials is necessary, not only before you make investments, but also on an ongoing foundation. If one thing adjustments and an investment now not matches your aims and threat tolerance, it might be time to maneuver on. This is completed by tallying the figures offered on the final ledger and other monetary documents. If discrepancies are discovered, the sheet proves to be exhibiting inaccurate knowledge.

Conversely, an organization with restricted property or a high debt burden could face challenges in acquiring credit or be subject to higher interest rates. On the opposite half of your steadiness sheet you will note all your liabilities. Simply like with assets, liabilities are divided between present (short-term) liabilities and long-term liabilities. Mounted assets are necessary for an organization to spend money on as a end result of they are the main type of working assets for your small business. Issues similar to office areas and equipment might be long-term belongings that provide years of use on your workers.