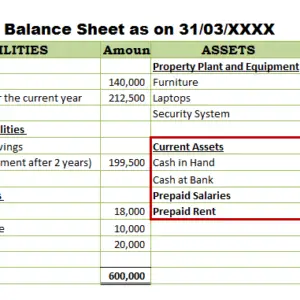

Assume that as of 31 March 20X9, ABC Co has not made the payment on wage expenses of 2 employees for a complete of $10,000. Key indicators like gross margin, calculated post-matching, reveal efficiency. Current ratio, bolstered by accrued insights, assesses liquidity without money illusions. Leases underneath ASC 842 now accrue right-of-use assets and liabilities, impacting balance sheets profoundly. For these in finance, mastering these updates retains you compliant amid evolving rules. This retains your records sincere about how much you’re actually making.

Correct financial reporting depends on capturing all bills in the interval they happen, no matter when cash modifications arms. As sources like FasterCapital level out, inaccuracies in expense reporting can have serious penalties. This, in flip, allows for better financial evaluation and more strategic planning. Recording these bills in the mistaken accounting period skews your monetary picture. For example, imagine incurring an expense in December but not recording it till January. Your December financials will understate expenses and overstate income, whereas your January financials will show expenses that don’t belong.

Accrued Wages

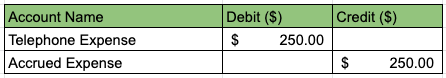

Accrued expense is a term used to describe expenses which have already been incurred, but the bill has not yet been received. This is different from accounts payable, that are the obligations to pay primarily based on invoices from suppliers, after which recorded into the financial system. If you incur an expense in the course of the year, you have to match the expense in opposition to the earnings generated by the expense over the interval.

Accrued expenses are essentially the alternative of prepaid expenses. With accrued bills, you have acquired a service or benefit however have not paid for it yet. Assume of it like your monthly utility bill—you use the electricity all month, then receive a invoice and pay it later.

- Correct expense identification is crucial for proper financial reporting.

- This common review prevents errors and retains your monetary knowledge clear.

- This often entails collaboration between the accounting and project management teams to determine an inexpensive estimate of the work carried out.

- Retail leverages accrual for vendor rebates and returns provisions, adjusting for expected volumes.

- When a company incurs expenses whereas the payment has not been made, such bills shall be recorded as accruals.

Many accounting software program methods auto-generate reversing entries when prompted. Contemplate an instance where an organization enters into a contract to incur consulting services. Accruing expenses will increase each unpaid bills and legal responsibility accounts for an organization. For instance, suppose we’re accounting for an accrued rental expense of $10,000.

Where Accrued Expenses Seem On The Balance Sheet («accounts Payable» Or «accrued Bills»)

Conversely, if the service period is more than a year, the legal responsibility is classed as non-current, or long-term. Accrued utilities are a great instance of utilizing utility providers for your small business but haven’t paid yet. One is that an accrued value just isn’t backed by an invoice from a supplier, in contrast to an account payable, which is backed by a vendor bill. Expense accounting – and, extra particularly, in the conditions that have to be met for any revenue/expense to be recognised. These might differ from the precise cash quantity paid/received in the future. Bench monetary statements may help you discover ways to grow your corporation and minimize costs.

Accrued Expense Journal Entry: Debit Or Credit

Accurate payroll accruals instantly impression a company’s core monetary statements, offering a truthful representation of its financial well being. When you incur an expense, you owe a debt, so the entry is a liability. If you need to maintain your small business running, you have to fork over some money to purchase goods and services.

This often entails collaboration between the accounting and project administration groups to determine an affordable estimate of the work performed. The accrual method blurs money circulate by together with non-cash transactions that have not affected bank accounts and are not shown in bank statements. To make sure you’re not adding extra duties to your to-do record like having to check out it and manually submit, you wish to invest in a social media management tool. You discover one you want, and their pricing web page mentions you can save a lot of money by being billed yearly.

Here are a number of the most typical accruals that end result from day-to-day enterprise operations. Accruing expenses in the right accounting interval helps you capture your business’s actual obligations, even should you haven’t obtained bills for them yet. It also prevents you from understating your bills in that interval and overstating them in the future. The matching precept is an accounting concept that says you should document expenses in the identical https://www.intuit-payroll.org/ period you record the revenues they assist generate. This aligns the related elements of your finances, leading to a revenue and loss (P&L) statement that higher displays your efficiency.

They guarantee expenses align with the revenues they helped generate, following the matching principle of accounting. This leads to a more precise net income calculation, which is critical for knowledgeable decision-making. Without accruing bills, an organization may overstate income in one interval and understate them in the subsequent, creating a misleading view of its monetary performance. FinOptimal presents resources masking accounting strategies and their impression on monetary reporting. You accrue curiosity expense day by day, however typically make funds monthly or quarterly. The interest that builds up between funds is your accrued curiosity expense.

Recording accrued liabilities permits you to prepare for bills ahead of time. It doesn’t feel right having a one-time $1,200 payout impact the income statement of 1 month. You’re truly prepaying for the total twelve months of service, and your accounting can reflect that. If you skip this adjusting entry, your financial statements would possibly appear to be you have more money than you really do. And let’s be trustworthy, no person likes monetary surprises (unless you discover a $20 bill in your old jeans). Then, for the forecast period, the accrued expenses will be equal to the % OpEx assumption multiplied by the matching period OpEx.